Restructured financial services business

The financial services business was one that had then complemented the Group’s banking business. This business unit was restructured after the merger of CMS Capital Sdn Bhd and K&N Kenanga Holdings Berhad.

The financial services business was one that had then complemented the Group’s banking business. This business unit was restructured after the merger of CMS Capital Sdn Bhd and K&N Kenanga Holdings Berhad.

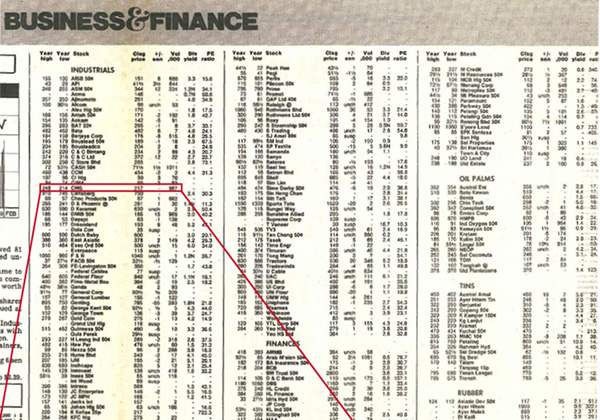

Previously, CMS Capital Sdn Bhd was the holding company of Sarawak Securities Sdn Bhd (SSSB) and Sarawak Securities Futures Sdn Bhd; SSSB was the first licenced stockbroker in Sarawak and commenced operations in 1992 as a member company of the Kuala Lumpur Stock Exchange. Through the merger, Sarawak Securities Futures Sdn Bhd and SSSB were sold to K&N Kenanga.

The financial business, which was under CMS Capital Sdn Bhd then restructured and housed CMS Trust Management Sdn Bhd; K&N Kenanga Holdings Bhd; CMS Dresdner Asset Management Sdn Bhd, a joint venture between CMS Group and the Dresdner Group; and CMS Mezzanine Sdn Bhd, which executed mezzanine and related financing activities.

On 26 December 2000, CMS Capital Sdn Bhd entered into an exchange agreement with Peninsular Malaysia-based stockbroker K&N Kenanga Holdings Berhad to transfer CMS’ securities and futures business to K&N Kenanga in return for shares in K&N Kenanga.

On 26 December 2000, CMS Capital Sdn Bhd entered into an exchange agreement with Peninsular Malaysia-based stockbroker K&N Kenanga Holdings Berhad to transfer CMS’ securities and futures business to K&N Kenanga in return for shares in K&N Kenanga.

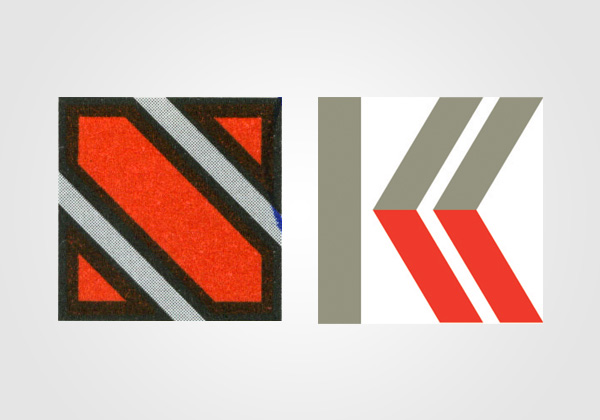

Following a period of rapid diversification, on 15 December 1996, the CMS Board agreed to change the company’s name from Cement Manufacturers Sarawak Berhad to Cahya Mata Sarawak Berhad, subject to approval from the Sarawak State Secretary’s Office. This was obtained in a letter dated 5 March 1996, and the change was officially made on 13 June 1996. ‘Cahya Mata’ in Malay refers to a special child or literally ‘apple of the eye.’ Thus Cahya Mata Sarawak can mean ‘Sarawak’s favourite son.’ This concept has been further extended through CMS’ current vision statement, “To be the PRIDE of Sarawak and Beyond”. The CMS logo was also changed from the angular blue design to the present on comprising the colours of the Sarawak flag: yellow, red and black. The interlocking shapes of the logo reflect the concepts of yin and yang and represent the Group’s two main divisions at the time: infrastructure and investment.

Following a period of rapid diversification, on 15 December 1996, the CMS Board agreed to change the company’s name from Cement Manufacturers Sarawak Berhad to Cahya Mata Sarawak Berhad, subject to approval from the Sarawak State Secretary’s Office. This was obtained in a letter dated 5 March 1996, and the change was officially made on 13 June 1996. ‘Cahya Mata’ in Malay refers to a special child or literally ‘apple of the eye.’ Thus Cahya Mata Sarawak can mean ‘Sarawak’s favourite son.’ This concept has been further extended through CMS’ current vision statement, “To be the PRIDE of Sarawak and Beyond”. The CMS logo was also changed from the angular blue design to the present on comprising the colours of the Sarawak flag: yellow, red and black. The interlocking shapes of the logo reflect the concepts of yin and yang and represent the Group’s two main divisions at the time: infrastructure and investment.